The Big Churn: Job Openings and Quits Rise Again in June

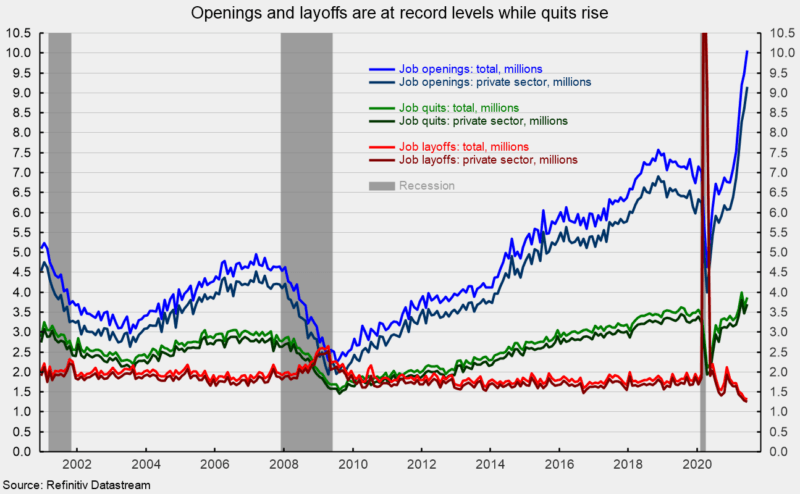

The latest Job Openings and Labor Turnover Survey from the Bureau of Labor Statistics shows the total number of job openings in the economy rose to 10.073 million in June, up from 9.483 million in May, and a new record high. The number of open positions in the private sector increased to 9.154 million in June, up from 8.601 million in May, also a new record high (see first chart).

The total job openings rate, openings divided by the sum of jobs plus openings, rose to a record 6.5 percent in June while the private-sector job-openings rate surged to a record 6.9 percent.

Private hires in June totaled 6.286 million versus 5.703 million in May. At the same time, the number of private-sector separations rose to 5.311 million in June, up from May’s 5.047 million. Within separations, private quits were 3.701 million (versus 3.470 million in May) and private layoffs were 1.255 million, down from 1.281 million in the prior month (see first chart).

The total separations rate rose to 3.8 percent from 3.7 percent in the prior month with the private sector experiencing a rate of 4.3 percent, up 0.2 percentage points from 4.1 percent in May. The private quits rate rose to 3.0 percent from 2.8 percent in May while the private layoffs rate held at a very low 1.0 percent.

Four industry categories have more than 1.4 million openings each: trade, transportation, and utilities (1.884 million), professional and business services (1.789 million), education and health care (1.683 million), and leisure and hospitality (1.650 million; see second chart).

The highest openings rates were in leisure and hospitality (10.1 percent), professional and business services (7.9 percent), education and health care (6.7 percent), trade, transportation, and utilities (6.5 percent), and manufacturing (6.3 percent; see third chart).

From the worker perspective, labor market conditions remained very favorable in June. The number of openings per job seeker (unemployed plus those not in the labor force but who want a job) jumped to 0.650 in June, down from 0.609 in May, and well above the May 2020 low of 0.156. This measure has risen sharply over the last few months and is now just shy of the 0.657 result from January 2020. It is also closing in on the record high of 0.721 in October 2019 (see fourth chart).

Overall, the data relating to the labor market continue to suggest a very tight, robust labor market where labor churn (workers changing jobs, presumably for better pay, better working conditions, or a new career path, or a combination of all of those) is elevated. The combination of June’s jobs report, which showed a net increase of 943,000 payroll jobs (though the gains were concentrated in leisure and accommodation as well as government), and private-sector business surveys which show businesses struggling to find and retain qualified workers support the conclusion of a very tight labor market.

No comments: